Is defined in section 101 of the Income Tax Ordinance 2001 which caters for Incomes under different heads and situations. Organizations that use Form 990 are federal income tax-exempt under the tax categories that are outlined in Section 501c Section 527 and Section 4947a of the Internal Revenue Code IRC.

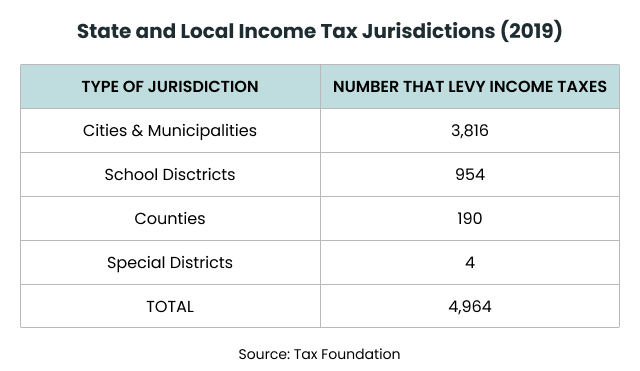

What Is Local Income Tax Types States With Local Income Tax More

Individuals and families Canada workers benefit.

:max_bytes(150000):strip_icc()/tax_shutterstock_584351497-5bfc325b46e0fb00511aeca8.jpg)

. Report on line 11600 of your return the amount of pension income. Corporations arent subject to both the franchise tax and the income tax. 2013 to enlarge the scope of definition of a Company.

If you owe more Idaho tax and dont send the written notice within 120 days we must apply a 5. Line 11600 Elected split-pension amount. Assembling your tax return.

Form 41 pages 1 and 2. An individual income tax or personal income tax is levied on the wages salaries investments or other forms of income an individual or household earns. Puts your balance due on the books assesses your.

There are two types of taxesdirect and indirectwhich are both parts of the tax. The Canada workers benefit CWB rates and income thresholds have changed for 2021. Include copies of all IRS schedules.

Report on line 11500 of your return the full amount in Canadian dollars of your US. A tax return is the completion of documentation that calculates an entity or individuals income earned and the amount of taxes to be paid to the government or government organizations or potentially back to the taxpayer. To e-file your federal tax return you must verify your identity with your AGI or your self-select PIN from your 2020 tax return.

Include a complete copy of your federal income tax return with your Idaho business income tax return. By law businesses and individuals must file an income tax. An income tax is a tax that governments impose on financial income generated by all entities within their jurisdiction.

Imposes a progressive income tax where rates increase with income. The definition of zero-emission vehicle has changed for vehicles acquired after. Actions that can extend the IRS collection timeframe include the filing of bankruptcy collection due process appeals or submitting an offer in compromise or innocent spouse claim.

This can have an impact on a Federal tax lien. Is an employee or official of the Federal Government or a Provincial Government posted abroad in the Tax Year. A federal tax lien is the governments legal claim against your property when you neglect or fail to pay a tax debt.

For more information see Schedule 6 Canada Workers Benefit. You can claim a deduction for part of this income. A new secondary earner exemption has also been introduced.

A federal tax lien exists after. Social Security benefits and any US. United States Social Security.

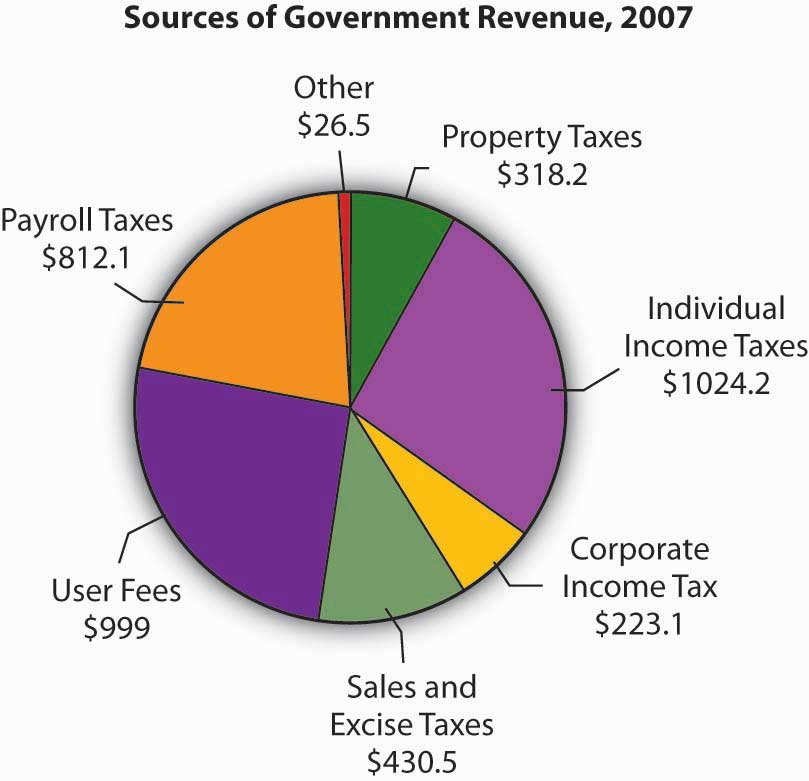

If your federal taxable income or tax credits change because of a federal audit you must send written notice to the Tax Commission within 120 days of the final federal determination see Rule 890. Taxation is one of the biggest sources of income for the government. Medicare premiums paid on your behalf.

The Federal Income Tax was established in 1913 with the ratification of the 16th Amendment. Explore updated credits deductions and exemptions including the standard deduction personal exemption Alternative Minimum Tax AMT Earned Income Tax Credit EITC Child Tax Credit CTC capital gains brackets qualified business income deduction 199A and the annual. Now as per Income Tax Ordinance 2001 a company.

These actions stop the IRS from collecting. To make sure your return is correctly processed include all forms and schedules in the following order. The IRS recently released the new inflation adjusted 2022 tax brackets and rates.

Income tax in Australia is imposed by the federal government on the taxable income of individuals and corporations. State governments have not imposed income taxes since World War IIOn individuals income tax is levied at progressive rates and at one of two rates for corporationsThe income of partnerships and trusts is not taxed directly but is taxed on its. The lien protects the governments interest in all your property including real estate personal property and financial assets.

Page Last Reviewed or Updated. Because of that this time is added back on to the collection statute.

How Do State And Local Individual Income Taxes Work Tax Policy Center

Income Tax Definition What Are Income Taxes How Do They Work

:max_bytes(150000):strip_icc()/tax_shutterstock_584351497-5bfc325b46e0fb00511aeca8.jpg)

Taxable Income Vs Gross Income What S The Difference

:max_bytes(150000):strip_icc()/taxes-4188113-final-1-650f90dd44bf47c1bf1fb75727a58565.png)

Taxes Definition Types Who Pays And Why

Types Of Taxes Income Property Goods Services Federal State

Income Tax Why Do We Pay Federal Income Tax H R Block

Government Revenue Taxes Are The Price We Pay For Government

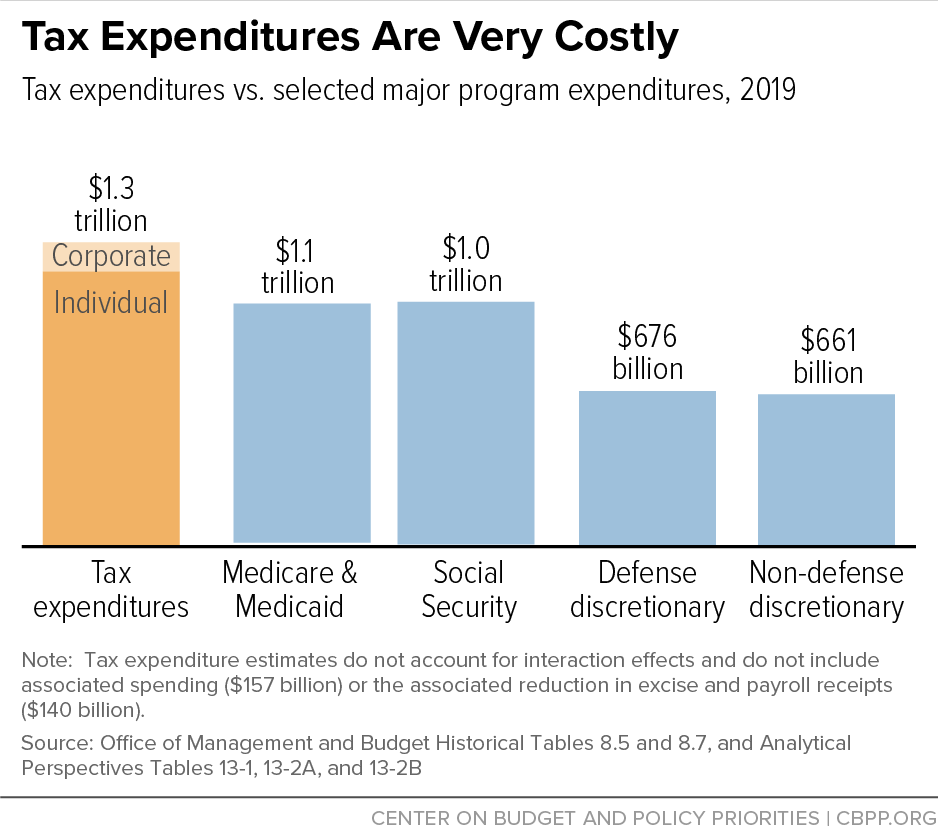

Policy Basics Federal Tax Expenditures Center On Budget And Policy Priorities

Income Tax Definition What Are Income Taxes How Do They Work

Average Tax Rate Definition Taxedu Tax Foundation

Average Tax Rate Definition Taxedu Tax Foundation

/Incometaxes-9dacb2fc1d314896821b07f3933f0c4e.png)

Taxes Definition Types Who Pays And Why

How Do Taxes Affect Income Inequality Tax Policy Center

Income Tax Rates For The Self Employed 2020 2021 Turbotax Canada Tips

What Are Tax Credits And How Do They Differ From Tax Deductions Tax Policy Center

What Does The Irs Do And How Can It Be Improved Tax Policy Center

:max_bytes(150000):strip_icc()/ScreenShot2021-05-17at12.36.12PM-22c6287a600548be8be11533f7eed51b.png)